Create your own Payment Gateway With full

Speed.

Control.

Confidence.

Speed.

Control.

Confidence.

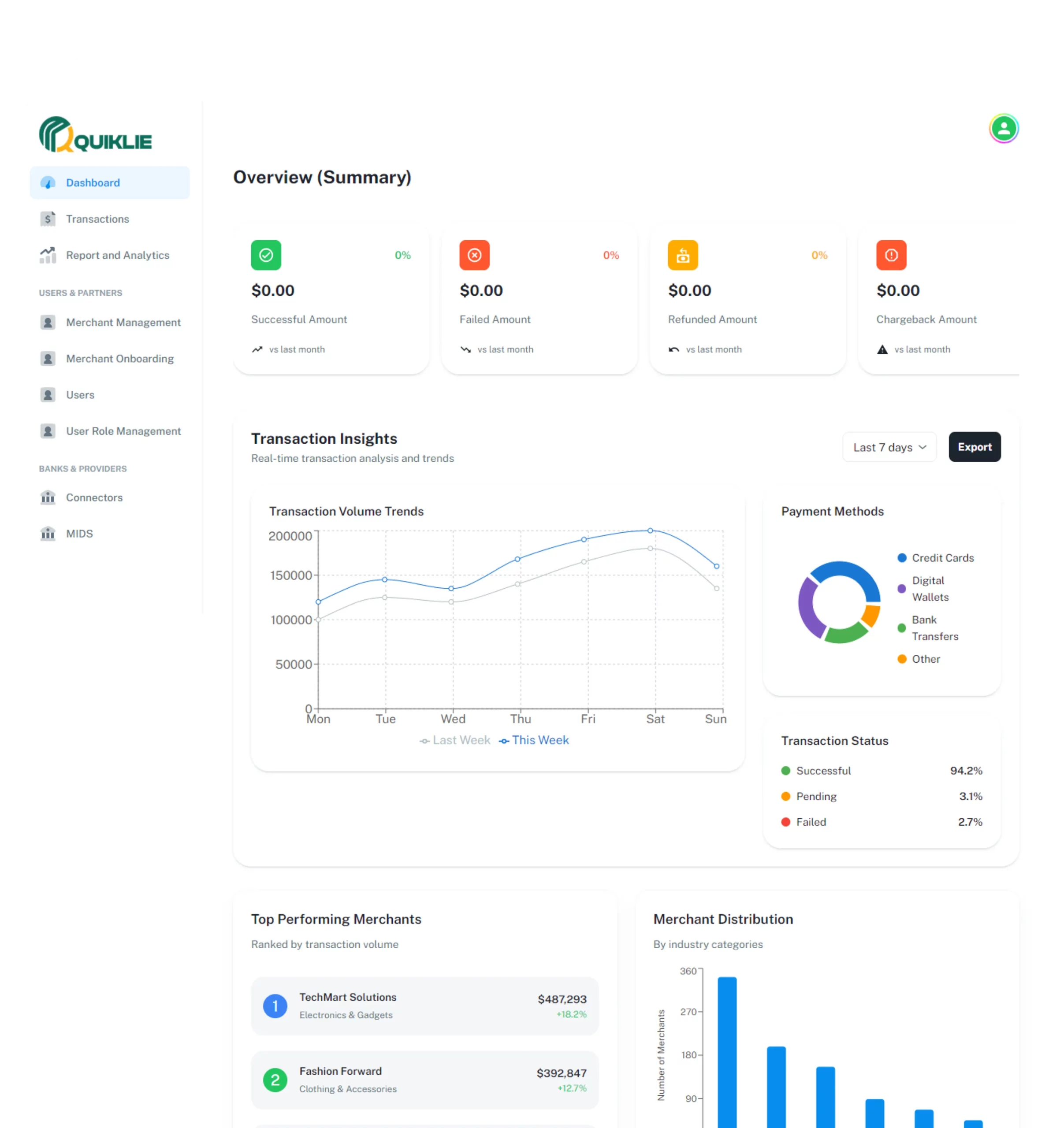

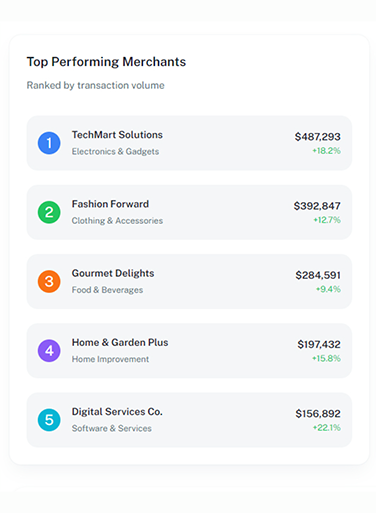

Quiklie by Levanta Payments empowers ISOs, PSPs, and fintech teams to deploy a fully brandable, production-ready payment gateway with bank integrations, merchant onboarding, pricing control, routing logic, and payouts all managed from a single, simple dashboard.

Above Approval Rate!

Payment Infrastructure You Don’t Need to Build

Building a payment infrastructure shouldn’t require months of development, large engineering teams, or complex multi-bank integrations. Quiklie eliminates that burden by providing a complete, production-ready payments stack the moment you onboard.

Quiklie replaces the hardest parts of payment infrastructure:

- Your Bank Connections

- Your Merchant Ecosystem

- Your Pricing Framework

- Your Routing Engine

- Your Payout Operations

No tech team required. No six-month build. No complexity.

With Quiklie, there’s no need for a technical team, lengthy integrations, or custom builds. Simply configure your setup, assign your banks and merchants, and go live faster than any traditional gateway deployment.

In a market where speed and adaptability define competitive advantage, waiting six months to launch payments is no longer acceptable.

ZERO DOWNTIME

GLOBAL COMPLIANCE

BRING YOUR OWN BANK

HIGHLY SECURED

SEAMLESS INTEGRATION

ZERO DOWNTIME

GLOBAL COMPLIANCE

BRING YOUR OWN BANK

HIGHLY SECURED

SEAMLESS INTEGRATION

Built for ISOs. Supercharged for PSPs.

Everything you need to run a full-fledged payment gateway, without legacy complexity or long build times.

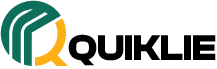

Bring Your Own Bank

Choose any acquiring bank and activate integrations instantly when already supported. Quicklie handles new integrations for you, enabling effortless multi-acquirer management, fast routing flexibility, and complete operational control without requiring external developers or lengthy engineering involvement at any stage.

Instant Merchant Onboarding

Onboard merchants in minutes using automated verification, streamlined approvals, and customizable pricing assignments. Once accepted, Quiklie instantly generates merchant dashboards, ensuring a consistent onboarding experience that eliminates manual work, reduces delays, and simplifies operational processes .

Full Pricing Control

Configure detailed pricing for every merchant, including MDR, reserves, commissions, payout cycles, and specialized fees. Quiklie centralizes everything into one interface, providing complete flexibility to optimize revenue and reduces the complexity associated with fragmented pricing systems or manual spreadsheet management.

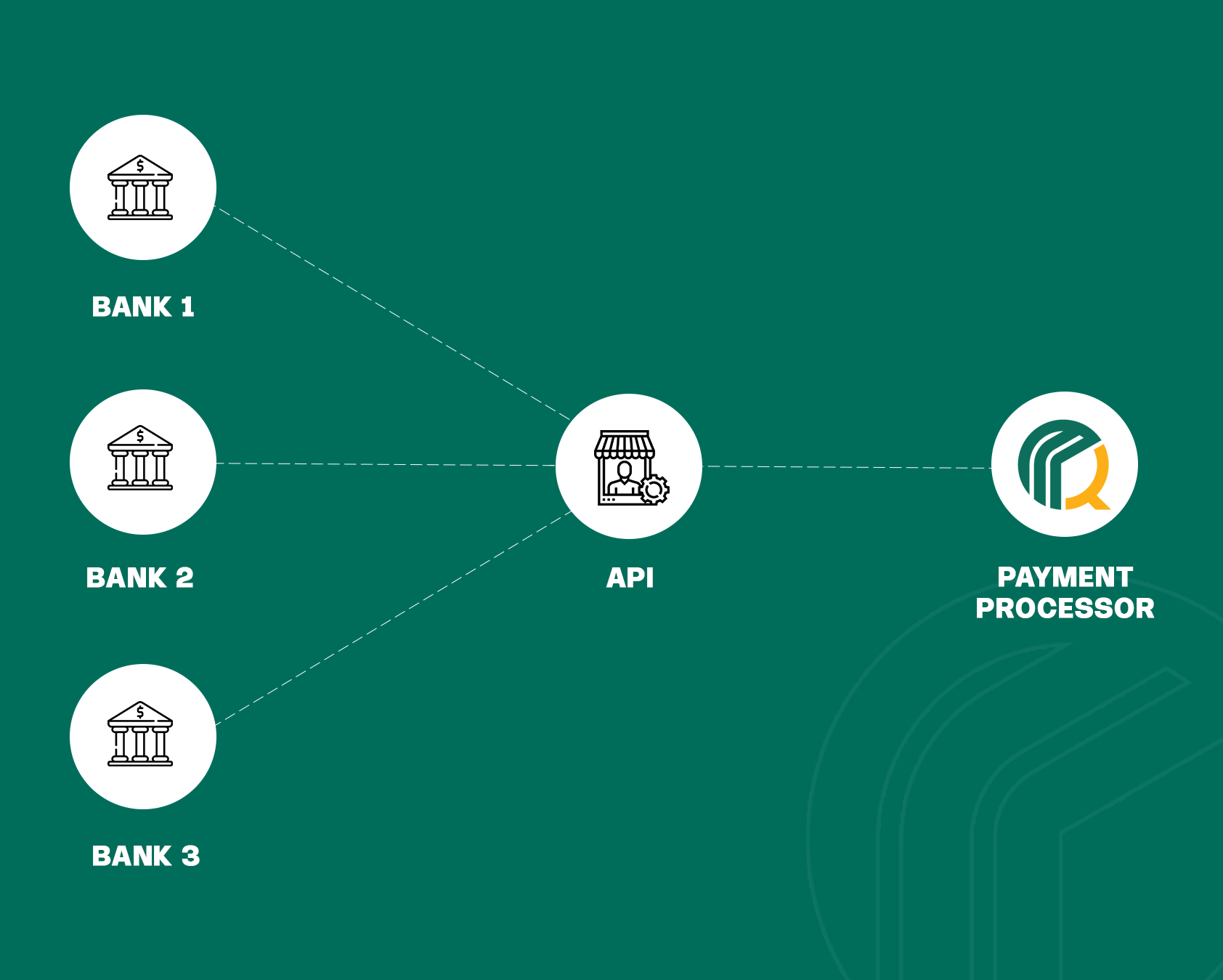

Smart Routing & Payment Orchestration

Route transactions across multiple banks using intelligent rules based on volume, success rates, or payment types. Quiklie automatically adapts routing to maximize approvals and uptime, providing seamless performance for merchants without exposing or requiring them to manage complex underlying orchestration logic.

Automated Broker / Affiliate Commissions

Invite brokers or partners, assign flexible commission models, and automatically track referred merchants. Each broker receives a personal dashboard with real-time earnings, referral activity, and payout visibility, eliminating disputes, reducing manual calculations, and enabling a transparent, streamlined revenue-sharing ecosystem .

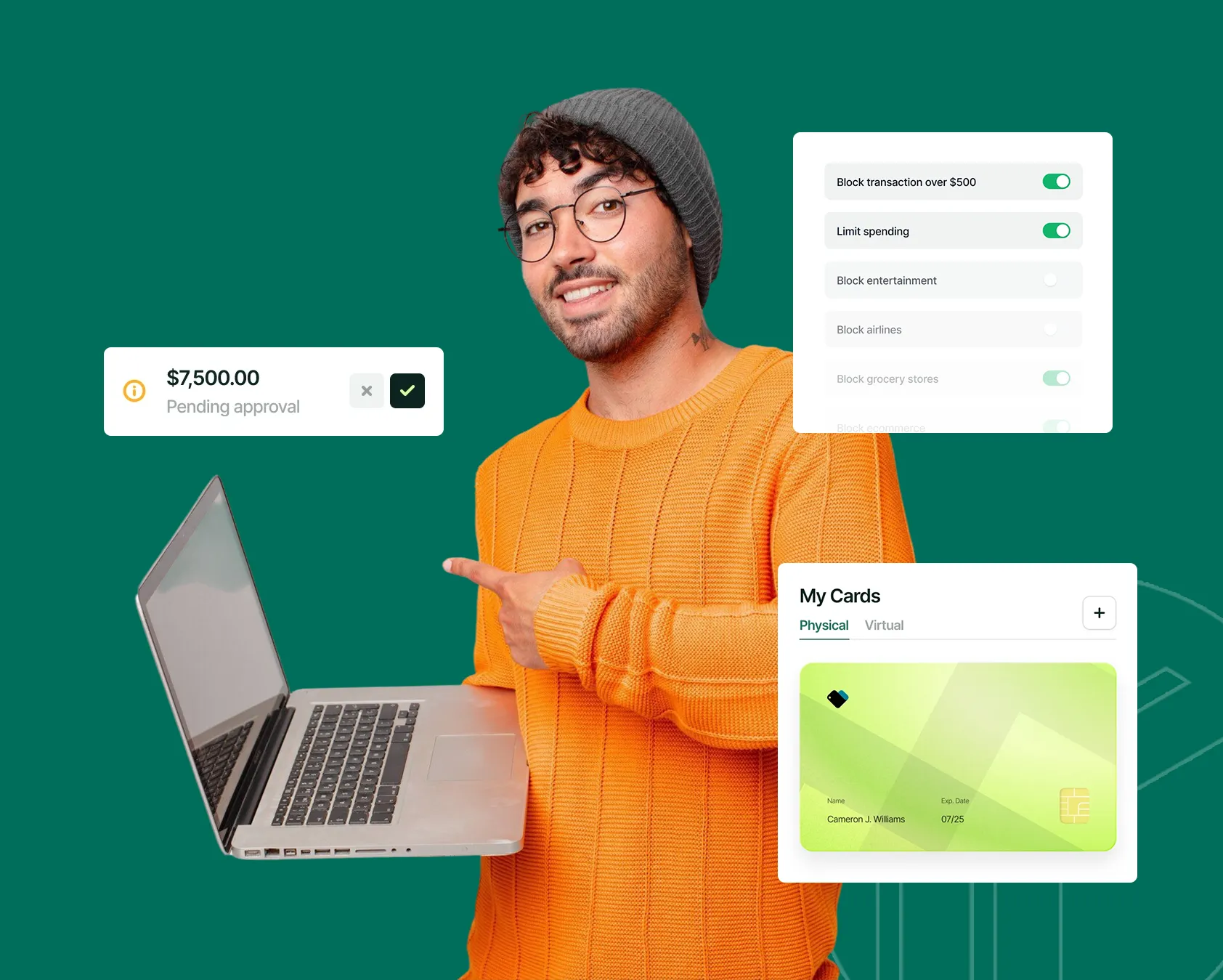

Clean Settlement & Payout Reporting

Quiklie separates settlement data from payout information to ensure accurate financial clarity. Access real-time transaction totals, generate export-ready reports, simplify reconciliation tasks, and maintain clean, audit-friendly accounting across all merchants and banking partners within one unified operational and transparent reporting.

Deploy a Complete Gateway

in Four Simple Steps

Create Your Account

Connect Your Bank

Onboard Your Merchants

Launch & Start

Choose a plan that grows with

your business.

Quiklie gives you everything you need to launch, manage, and scale without costly engineering, slow integrations, or operational bottlenecks. Whether you’re starting with a small portfolio or running high-volume processing across regions, our plans are designed to match your pace and complexity.

Tier 1

- 100 transactions included

- $1/transaction above 100

Tier 2

- 5000 transactions included

- $0.50/transaction above 5,000

Tier 3

- 20,000 transactions included

- $0.25/transaction above 20,000

Tier 4

- 50,000 transactions included

- $0.10/transaction above 50,000

Ready to Boost Your Business to the Next Level?

Got Any Questions?

Yes. Quiklie is a fully white-label payment gateway, allowing you to launch the platform under your own brand name, logo, domain, and UI—without any Quiklie branding visible to your merchants.

With Quiklie, you can launch your own payment gateway in days instead of months. The platform is production-ready, reducing development, testing, and integration timelines significantly.

Yes. Quiklie supports cross-border and international payment processing through compatible acquiring banks, making it suitable for global merchants and fintech companies.

Yes. Quiklie supports high-risk merchant processing with customizable rules, smart routing, reserve management, and risk controls to reduce chargebacks and transaction failures.

Quiklie supports multiple payment methods depending on bank integrations, including credit cards, debit cards, and alternative payment options supported by acquiring partners.

Yes. Quiklie provides real-time transaction tracking, allowing administrators to monitor approvals, declines, settlements, and refunds instantly from a centralized dashboard.

Absolutely. Quiklie offers a unified admin dashboard to manage multiple merchants, view transaction histories, configure pricing, and control settlements from one place.

Quiklie uses intelligent transaction routing and failover mechanisms to redirect payments to the best-performing banks, improving authorization rates and minimizing downtime.

Yes. Quiklie is ideal for startups and emerging fintech companies looking to enter the payment processing space quickly without investing heavily in infrastructure or engineering teams.

Yes. Quiklie supports recurring billing and subscription-based payments, making it suitable for SaaS platforms, membership services, and subscription businesses.

Yes. Quiklie allows flexible settlement scheduling, enabling you to define daily, weekly, or custom payout cycles based on merchant agreements.